426,000 Active Sessions in Four Months for Financial Services App

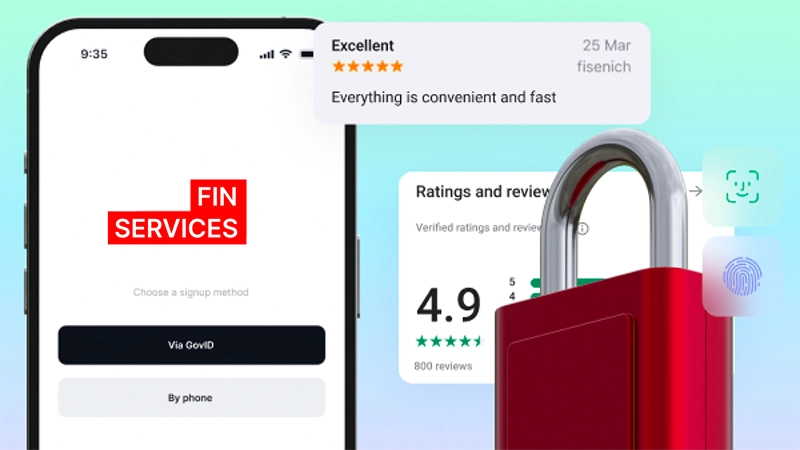

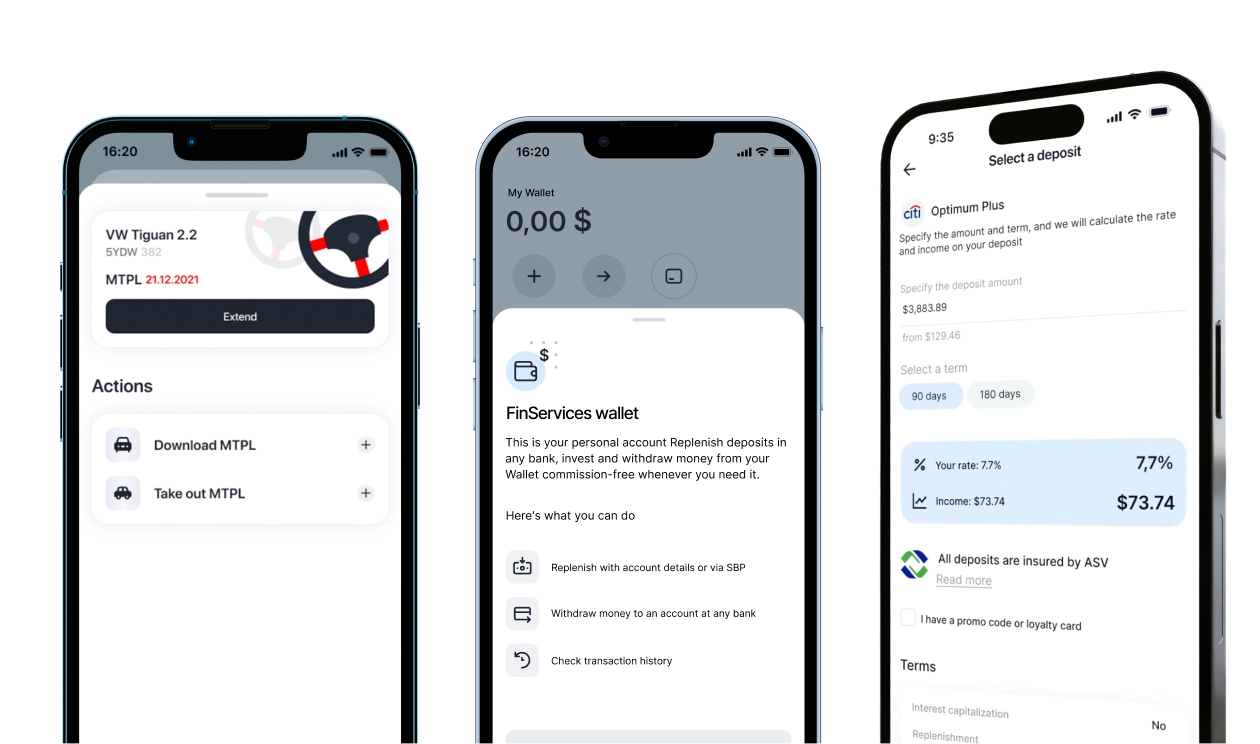

We built FinServices — a single mobile app that unifies banking and insurance offers in one place, removing the need for branch visits and enabling on-phone deposits and insurance applications.

Client & Context

FinServices set out to aggregate banking and insurance products in one app and let users compare offers and complete transactions on their smartphones — targeting Millennials, Gen X, and Gen Z.

Goals

- 1Consolidate finance & insurance journeys in one app.

- 2Ship high-performance native apps for iOS and Android in a six-month window.

- 3Make deposits and insurance applications effortless on mobile.

Challenges

- Concept clarity: not a bank, not only an aggregator — UI must feel trustworthy yet neutral.

- Reliability at scale: millions of users, many partners, sensitive flows.

- Timeline: deliver native apps in 6 months.

Building a Banking App Users Prefer

Discovery & Concept

We co-shaped the product through market/competitor research and defined the app as a super-app for finance/insurance with clear, comparable offers and seamless in-app actions.

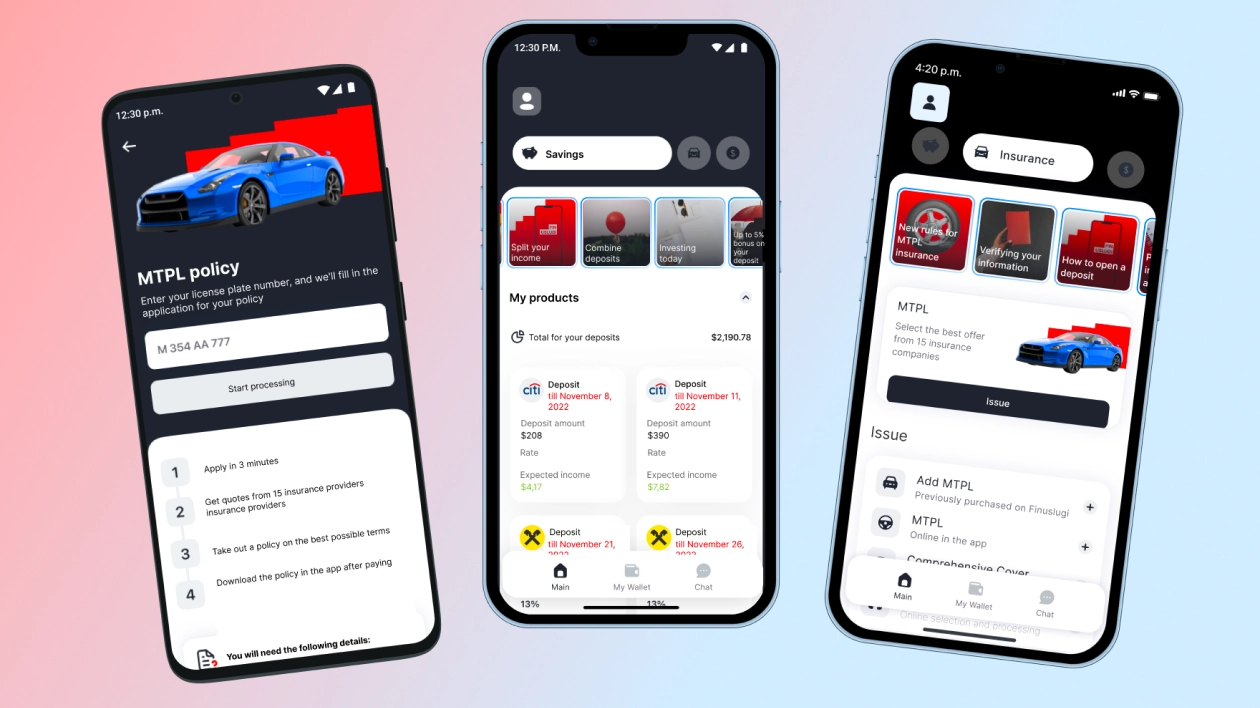

Finance and Insurance screens

Native iOS & Android

We delivered high-performance native apps — Swift and Kotlin, prioritizing responsiveness, stability, and quality gates for release.

Mobile-First UX

Clean cards, focused forms, and predictable feedback reduce cognitive load and make financial tasks easy to complete on small screens.

Core Journeys

Users can compare and apply for deposits and insurance in-app; personal accounts keep loans, deposits, savings, and policies in one place.

Core Journeys

Risks & How We Mitigated Them

Missing the deadline

Mitigation. We fixed a short, weekly milestone rhythm and only moved forward after each milestone was approved.

Decision bottleneck. Design/dev blocks while waiting for feedback

Mitigation. We booked fixed review windows and applied a “silent approval after 48 hours” rule for non-critical items.

Team member unavailability. A key designer or developer becomes unavailable

Mitigation. We kept specs and demo recordings up to date and assigned a backup owner for each critical area.

Compliance & Security

Results

A single mobile app now lets users compare and manage finance and insurance products anytime, anywhere.

Within two months of launch the app surpassed 18k installs. By month four it reached 58k installs, 426k active sessions, and 36k registered users.